Congress is debating an economic stimulus package that would substantially increase federal spending, but may not speed recovery from the current recession. The Congressional Budget Office estimates that less than 40 percent of the proposed infrastructure spending in the stimulus bill will be spent within two years.

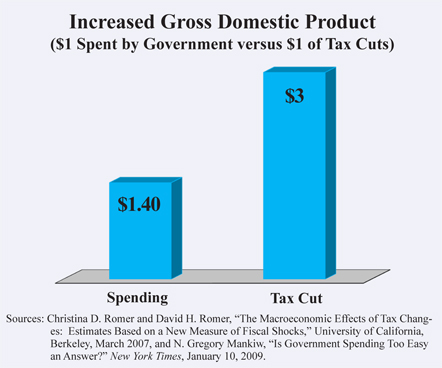

Tax cuts, by contrast, can have an immediate effect. Furthermore, a recent study by Christina D. Romer, one of President Obama's top economic advisers, found that a dollar of tax cuts raises gross domestic product (GDP) by about $3, more than twice the effect of a dollar increase in government spending. [See the figure.]

Some provisions of the stimulus bill would provide tax relief, but not all tax cuts have the same effect. Congress should consider some better, bolder tax-cutting ideas to speed economic recovery.

Weak Stimulus Idea: "Make Work Pay" Initiative. This Obama campaign promise would give a payroll tax credit of $500 to individuals and $1,000 to couples by cutting withholding taxes for 2009 and 2010. However, the credit would be phased out for higher income earners. Individuals making more than $100,000 and couples earning more than $200,000 would not receive it. Economist Joel Slemrod, of Michigan State University, found that the tax rebates sent out in 2007 and 2008 had little economic effect. Individuals spent about one-third of their rebate checks and saved the rest.

A Bolder Idea: Cut Payroll Tax Rates. For about the cost of the $825 billion House version of the stimulus bill, payroll taxes for Social Security could be cut in half, says former Federal Reserve Board member Lawrence B. Lindsey. A 3 percentage-point reduction in payroll taxes would increase workers' take home pay an average of $1,500. Reducing the employer's tax share by 3 percentage points would increase businesses' cash flow an average of $1,500 per worker. This tax cut would reduce unemployment by lowering labor costs.

Weak Stimulus Idea: Alternative Minimum Tax Relief. Some Democrats have proposed including alternative minimum tax (AMT) relief in the stimulus bill. The AMT was originally designed to ensure that wealthy Americans paid some tax on their income by eliminating many deductions, but an increasing number of middle-class taxpayers are required to pay the AMT because it was not indexed for inflation. Adding an AMT patch to the stimulus bill would keep taxes from rising, but it would not directly affect levels of income tax withholding and thus would not speed recovery.

Stronger Stimulus Idea: Increase Immediate Expensing. President Obama has proposed increasing the amount of investment in property, plant and equipment small businesses can immediately expense (deduct) from their taxable income, rather than depreciate over a number of years. The amount small businesses could expense would increase from $175,000 to $250,000. Businesses of all sizes could expense 50 percent of equipment spending. However, the increased expensing would only be allowed for one year.

A Bolder Idea: Unlimited Expensing. If businesses were allowed to expense all of their investment for the next several years, it would have an immediate effect. Economist Stephen J. Entin points out that requiring a business to depreciate investment over a number of years reduces the value of the deduction – a dollar today is worth more than a dollar a year from now, due to interest costs and inflation. By reducing the tax burden on capital, immediate expensing would increase the amount of investment.

Strong Stimulus Idea: Allow Businesses to Deduct Current Losses from Past Earnings. President Obama has also proposed allowing companies to count losses for 2008 and 2009 against taxable income earned during any of the previous five years, extending the period of deductibility from two years. Businesses would receive a refund of previous years' income taxes to offset these losses. This would benefit companies that have difficulty obtaining credit by increasing their cash flow.

A Better Idea: Cut Corporate Tax Rates. Cutting taxes on future profits is much more likely to spur new investment. Congressional Republicans propose a step in the right direction: reducing the corporate income tax rate from 35 percent to 25 percent – the average rate in the European Union. This would encourage businesses to hire additional workers, accelerate investment and make American companies more competitive internationally.

A Better Idea: Cut Capital Gains Tax Rates. Republicans have also proposed reducing the capital gains tax levied on the increased value of an asset, such as stock or real estate, when it is sold. The current 15 percent rate is scheduled to rise to 20 percent as the Bush tax cuts expire. Making the lower rate permanent would be helpful. Past capital gains tax cuts have yielded an immediate increase in government revenue.

A Bolder Idea: Reduce Taxes on Overseas Capital. Overseas profits of U.S. corporations are taxed at U.S. rates when they are returned to the United States, whereas funds left abroad are taxed more lightly. Thus, a new study by Decision Economics, Inc., concludes that lowering the tax on repatriating foreign-earned income would inject $545 billion into the U.S. economy and raise tax revenue by an average of $28 billion per year for five years. The resulting increase in aggregate economic activity – higher personal income, corporate profits, capital gains, Social Security and excise taxes paid – would generate even more tax receipts.

A Bad Idea: Hike Estate Tax Rates. The United States currently has the third highest estate tax in the developed world at 45 percent, according to the American Council for Capital Formation. The estate tax is scheduled to be phased out for one year in 2010, but Democratic congressional leaders want to raise the base exemption while making the current rate permanent. The Joint Economic Committee of Congress estimates the estate tax has reduced the capital stock by approximately $847 billion. Former Congressional Budget Office Director Douglas Holtz-Eakin estimates that eliminating the estate tax would create roughly 1.3 million more small business jobs.

A Bad Idea: Hike Income Tax Rates. Congressional Democratic leaders also support a hike in the top two personal income tax brackets – from 33 percent to 36 percent and 35 percent to 39.6 percent, respectively. This would have an adverse effect on small business owners who report their business income on their personal tax returns. Raising the top two income rates would increase taxes on 51 percent of small businesses by $15.4 billion, according to the Tax Foundation.

Conclusion. Rather than massively increasing government spending, Congress should be lowering the tax burden on businesses and individuals. Tax relief for small businesses and self-employed entrepreneurs is especially important because small businesses account for about half of all private-sector employment and created 60 percent to 80 percent of new jobs over the past decade.

Allison Hughey is a research assistant at the National Center for Policy Analysis.