Banker greed and Wall Street are blamed, but government policies over the last 25 years are the root cause of the current financial crisis.

Among these policies, less stringent mortgage lending terms generated millions of subprime mortgages with a face value of several trillion dollars. Cheap money under Greenspan's leadership at the Federal Reserve led to a bubble in housing prices, which burst in 2006. Falling house prices, rising adjustable-rate mortgages (ARMs), negative home equity and rising foreclosure rates triggered widespread losses in the financial sector.

Unprecedented attempts by the Federal Reserve and the Treasury to strengthen the financial system have only been partially successful. The Obama Administration and the Democrat-controlled Congress pushed a deficit spending program of $800 billion-plus. Will this stimulus package bring about economic recovery?

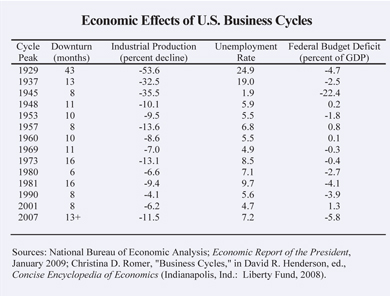

Worst Crisis since the 1930s? Since the business cycle peak of December 2007:

- Industrial production has declined 11.5 percent and the unemployment rate has risen to 7.6 percent.

- Real gross domestic product (GDP) fell at a 3.8 percent annualized rate in the fourth quarter of 2008.

- The duration of the economic contraction to date (13 months) already exceeds the average duration of contractions over the 10 cycles from 1945 to 2001.

However, the decline in industrial production and the unemployment rate in 2008 were not unusually severe compared to the major contractions that started in 1948, 1953, 1957, 1973 and 1981. The decline in industrial production was 4.7 times greater in 1929 than in 2008, and unemployment was 3.5 times as great in 1933. What economic news will come in 2009 is unknown, but the current economic contraction looks more like those that began in 1973 and 1981.

Keynesian Fiscal Stimulation. Keynes argued that when aggregate demand for goods and services declines during a severe economic downturn, the capitalist system will not automatically correct itself. That is, aggregate consumption and investment would remain insufficient to reduce the high unemployment and loss of potential output. The Keynesian solution substitutes short-run government deficit spending for private consumption, targeting job-creating infrastructure spending.

Moreover, Keynesians believe that every dollar of government spending increases GDP by more than a dollar due to the "multiplier effect." The Obama Administration assumes a multiplier of 1.5 for its stimulus package. Keynesians concede that tax cuts are also stimulative. However, they claim the multiplier effect for tax cuts is smaller because some of the tax reduction is saved rather than spent on consumption.

Size of the Deficit Spending Multiplier. The best evidence on the size of the spending multiplier is the effect on GDP of the very large military spending during World War II, which peaked at $7 trillion in today's dollars. Researchers have found a multiplier effect ranging from 0.8 to 1.4. For instance:

- Economist Valerie Ramey found that each additional dollar of government military spending increased GDP by $1.40.

- Susan Woodward and Robert Hall found a dollar for dollar effect of government military spending on GDP.

- Economist Robert Barro found that one dollar of government military spending increased GDP by only 80 cents.

On average, these findings indicate a $1 increase in GDP for each $1 increase in government military spending.

Moreover, contrary to Keynesian theory, tax reductions appear to have a greater multiplier effect on GDP, consumption and investment than spending. A recent study by Christina Romer (now chairman of the Council of Economic Advisers) and David Romer found that $1 of tax cuts raises GDP by about $3. The incentive effects of reduced tax rates explains this result.

The Stimulus. The Obama economic recovery package passed by the House of Representatives (H.R. 1) contains both individual and business tax relief (about $275 billion) and government spending (about $550 billion). The tax relief measures for individuals and businesses are mostly lump-sum payments, which evidence indicates are largely saved or used to pay down debt. Consequently, there will be little consumption increase from these payments.

Spending programs in the stimulus bill include $150 billion for health care, about $140 billion for education and about $90 billion for infrastructure. The Congressional Budget Office (CBO) estimates that only 38 percent of the new spending will occur by September 30, 2010. Including the tax relief, approximately 64 percent of the stimulus package will be spent by then. The bottom line:

- Only about $100 billion of new spending will occur during the next two years.

- Spending on infrastructure would only amount to $18 billion per year in 2009 and 2010.

- Even with an optimistic multiplier estimate of 1.5, the spending programs will only increase GDP about 1 percent per year above what it would be without the increased spending.

Problems with Stimulus Spending. To be effective, spending must occur during the contraction, not after it. (Tax relief is different because it occurs as income is being earned.) For spending, infrastructure needs to be surveyed, engineered, contracted and built, a process that can take years, not months. A cursory examination of federal budgets during the 14 contractions that occurred from 1929 to 2008 shows no relationship between deficit spending and the decline in industrial production. [See the table.] Most of the deficit spending that arose during these business cycles occurred after the economic recovery had begun. In fact, if spending occurs toward the peak of a recovery, it can contribute to inflation.

The current stimulus proposal is a government spending bill, with money for new or expanded programs planned for the future. Particularly worrisome is the increased government intervention in health care and education. The bill moves toward a nationalized health insurance system by expanding non-means tested Medicaid benefits and health insurance subsidies. There is also more direct federal financial involvement in education. Research by Robert Barro, and my own research, shows that when government spending reaches 20 percent to 25 percent of GDP, it reduces the rate of economic growth. As a result, increased spending will cause the budget deficit and government debt to rise:

- Combined with the existing deficit, the Obama stimulus package and the remaining $350 billion from the Troubled Assets Relief Program (TARP) will raise the budget deficit to more than 10 percent of GDP in 2009. This will be the largest budget deficit since World War II.

- The current federal debt of $10.7 trillion will possibly increase to $15 trillion by the end of 2012.

These IOUs will be paid with higher interest rates, inflation, increased taxation and a weakened U.S. dollar. Even the CBO admits that the stimulus bill will eventually reduce GDP, as increased government borrowing crowds out private investment. (The CBO says the Senate stimulus bill would increase GDP by as much as 4.1 percent this year, 3.6 percent in 2010 and 1.2 percent in 2011. However, by 2019, the Senate legislation would reduce GDP by one-tenth to three-tenths of one percent.)

Fixing the Root Cause. Government-deficit financing will not solve this economic crisis. The solution to the crisis lies in its root cause: the financial crisis. This crisis is a product of government policy – and Congress is to blame. Mortgages and securitized mortgage products have many banks teetering on insolvency. Until the financial crisis is solved, economic recovery will not occur.

Gerald W. Scully is a senior fellow with the National Center for Policy Analysis.