All over the developed world, countries are facing an extremely unpleasant budgetary reality: Per capita health care spending is growing at twice the rate of growth of per capita income.

Couple the fact that government promises of health care for the elderly are almost everywhere unfunded with the fact that pension promises are mostly unfunded and that aging populations mean an ever-increasing number of retirees per worker, and just about every first world country is projecting a fiscal nightmare.

Couple the fact that government promises of health care for the elderly are almost everywhere unfunded with the fact that pension promises are mostly unfunded and that aging populations mean an ever-increasing number of retirees per worker, and just about every first world country is projecting a fiscal nightmare.

So what is the answer? The Obama administration has made it about as clear as it is going to get that after the fall election its solution to trillion dollar deficits is going to be a value-added tax (VAT). But is that a good idea?

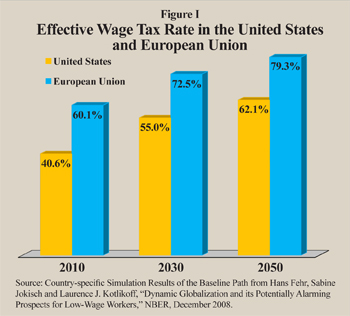

Expected Tax Rates. Economist Laurence Kotlikoff and his colleagues have estimated what tax rates will have to be if we stay on the present course and try to fund excess government spending with a VAT, a payroll tax or some other form of a consumption tax. As Figure I shows:

- In the United States, the average tax on wage income will rise from 40.6 percent today (a 15.3 percent payroll tax plus a 15 percent income tax plus state and local taxes) to 55 percent by 2030 and 62.1 percent by midcentury.

- If Europe follows the same path, the average tax on wage income will rise from 60.1 percent today to 72.5 percent in 2030 and 79.3 percent by 2050.

And note that these are average tax rates. Marginal rates will have to be even higher.

Theory versus Reality. But given that revenue has to be raised some way, isn't a VAT the best way to do it? Economists tend to like the VAT because it ultimately taxes consumption rather than production and by collecting the tax at every stage of production, it is harder to evade than a sales tax, which puts the full burden on the final transaction. But, as it turns out, no country really has a pure VAT. All kinds of goods and services are exempted or taxed at lower rates.

For example, Randall Holcombe reports that Belgium, with a standard VAT rate of 21 percent, also has rates of 12 percent, 6 percent and 0 percent. France, with a standard rate of 19.6 percent, has 5.5 percent and 2 percent rates. Overall, if the United States followed the European model, in order to collect 5 percent of value added we would need a tax rate of almost 10 percent.

For example, Randall Holcombe reports that Belgium, with a standard VAT rate of 21 percent, also has rates of 12 percent, 6 percent and 0 percent. France, with a standard rate of 19.6 percent, has 5.5 percent and 2 percent rates. Overall, if the United States followed the European model, in order to collect 5 percent of value added we would need a tax rate of almost 10 percent.

The Static Cost of a VAT. It turns out that a VAT also has high compliance and administrative costs, and these costs are largely independent of the rate. Holcombe has calculated that the cost to society (welfare loss) from a VAT rate of 2 percent is 56 cents for every dollar raised. For a 7 percent VAT rate, the cost is 33 cents for each dollar raised. This implies that it makes no sense to have a small VAT rate, but even a large one has heavy costs.

The Dynamic Cost of a VAT. Every tax discourages economic activity and the VAT is no exception. Based on a review of the literature, Holcombe calculates that a 10 percent VAT lowers the rate of economic growth by 10 percent. Based on this relationship, he finds that, measured in gross domestic product (GDP):

- After a 20-year period (by 2030), the loss of annual GDP for the United States from a VAT would be more than twice as much as the revenue collected.

- Moreover, at a lower than otherwise GDP, all revenue from all taxes would be lower, including state and local taxes.

- Considering all these effects, the net revenue to the government from a 3 percent VAT would be about one-tenth the loss of output for the economy as a whole in 2030.

- A 7 percent VAT, designed to bring in $915 billion in 2030, would in fact net less than one-third of that amount.

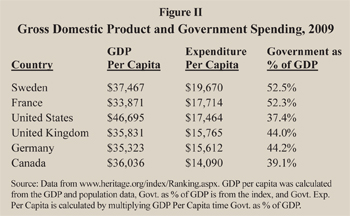

Holcombe concludes that higher taxes don't really bring in that much additional revenue. Instead of growing the government, they shrink the private sector. As Figure II shows:

- The French government doesn't really spend much more per person than government in the United States does; but because of its higher tax burden, France's per capita income is about $13,000 lower.

- Government spending per person in Sweden is only 12.6 percent higher than in the United States; but Sweden's income is almost $10,000 lower.

Conclusion. Imposed on top of existing taxes, a VAT would lower the rate of economic growth and therefore reduce the standard of living below what it would be otherwise. But it would do nothing to change the health care spending path we are on. Unless we find a way to reduce the rate of increase in health care spending (something the Obama administration has been loath to do), imposing a VAT would be a case of "all pain, no gain."

John C. Goodman is president and CEO and Kellye Wright Fellow at the National Center for Policy Analysis.