Source: Health Affairs Blog

There are two ways people can insure for medical expenses: third party insurance and individual self-insurance. Under the former, a third party (insurance company, employer or government) pays the expenses. Under the latter, people must save and pay the expenses directly, from their own resources.

This division of insurance responsibility is a normal aspect of every insurance market. In health care, however, the tax law complicates our choices. In general, employers are able to pay third party insurance premiums with pre-tax dollars (untaxed to the employee), whereas out-of-pocket payments by patients must normally be made with after-tax dollars. A second problem is that most families are not in the habit of saving while they are healthy for expenses that will arise with an unexpected illness.

To overcome these two problems, the law allows people to save on a monthly basis in tax-favored accounts by using several vehicles. Unfortunately, the rules governing these accounts are arbitrary and inconsistent — reflecting no clear public policy purpose. Under the Patient Protection and Affordable Care Act, things do not get much better. According to Roy Ramthun, a specialist in the field, newly announced regulations threaten the very existence of consumer-directed health plans in the individual market (including the anticipated health insurance exchanges). At the same time, their greater use may be encouraged in the large employer market.

In what follows, I will review some of the advantages and disadvantages of the various accounts. But let’s begin by jumping to the bottom line: none of them is ideal. As Mark Pauly and I explained in Health Affairs some time ago, an ideal account is one that does not distort incentives.

In the current period, people must choose between spending on health care and spending on other goods and services. When saving comes into play, people must choose between current and future health care and between future health care and future other goods and services. An ideal savings account is one that keeps all these choices on a level playing field with respect to the tax law. I call this account a Roth Health Savings Account, or Roth HSA.

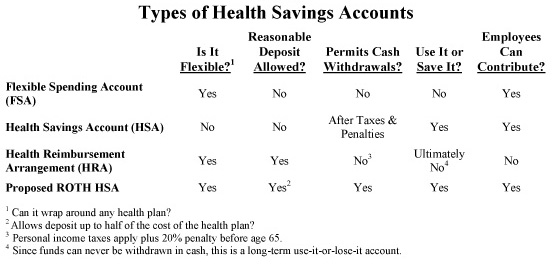

Comparing the Accounts. With all the acronyms in use these days, readers can be forgiven if they get confused. The table below gives an overview, but let’s start with the two most popular accounts: Flexible Spending Accounts (FSAs), which hold funds available only for the current period, and Health Savings Accounts (HSAs), with funds that roll over from year to year tax-free. In general:

- Both accounts are established by employers, and employees can make pre-tax deposits to them to pay medical expenses not covered by the employer’s health plan. The HSA contribution limits are currently $3,050 (individual) and $6,150 (family). Starting January 1, 2013, FSA deposits will be limited to $2,500 per employee.

- Employers are allowed to make deposits to both accounts; the HSA deposit is limited, but there is no limit to how much they can deposit in an FSA.

- HSAs must be combined with rigidly designed health insurance plans (with minimum and maximum deductibles, limits on out-of-pocket costs, etc.); in contrast, the FSA account is completely flexible — it can wrap around any health plan.

- Employees have a more secure property right in their HSAs; they can take their HSA funds with them when they leave an employer, but they have no legal right to unused FSA balances.

- The FSA account holder can never take the money out in cash; by contrast, employees can withdraw their HSA balances if they pay ordinary income taxes and a 20 percent penalty if the withdrawal is before age 65.

- Unlike the HSA approach of use-it-or-save-it, FSA accounts are use-it-or-lose-it; any account balance left at year end (or after an extra 2½ month grace period) is forfeited.

Although employers are allowed to make deposits to FSAs, few take advantage of this opportunity. Because of the use-it-or-lose-it feature, these plans are additions to, rather than integrated parts of, employer health plans. Because the deposits are tax free, they almost certainly add to health care spending as they are currently structured. They encourage employees to purchase designer eye glasses with pre-tax dollars, for example, rather than purchase other goods and services with after-tax dollars. At year end, employees will view almost any kind of wasteful spending as preferable to forfeiting the money left in the account.

Why are these accounts use-it-or-lose-it? Apparently this feature is the result of a Treasury Department ruling, not the result of any act of Congress.

Here is how Flexible Spending Accounts and Health Reimbursement Arrangements (HRAs) differ from each other:

- Like FSAs, the HRAs are also created by employers and they are completely flexible, in the sense that they can wrap around any health plan.

- Unlike FSAs, HRA balances roll over from year-to-year.

- Like the FSA, HRA balances can never be taken out in cash (so they are long-term use-it-or-lose-it).

- Finally both FSA and HRAs are notional accounts — in contrast to the HSA, no money is actually deposited in an employee-earmarked account — and employers can abolish the employees’ claims if they leave the company.

The 401(k) Option. Although 401(k) plans were never designed to function as a health account, the law does allow employees to make a hardship withdrawal for a large medical bill. The withdrawal must be for an immediate financial need for which the employee has no other funds available and it is subject to a 10 percent penalty plus federal income taxes.

Employees may also borrow from their 401(k) and this could be a source of funds to pay medical bills. Plans with loan provisions generally allow an employee to borrow up to half of a vested account balance, but not more than $50,000. Federal law requires that the borrower be charged a “reasonable rate” of interest, which is normally fixed at the prime rate plus 1 percentage point, and the loan must be repaid within five years.

The primary disadvantage of taking a 401(k) loan is the loss of compound interest and dividends that would have accrued if the money had not been borrowed. Moreover, the interest paid back into the account is unlikely to equal the interest earned by 401(k) investments. For example, if an account were earning a market interest rate of 6.25 percent, and a 47-year old plan holder borrowed $10,000 at a lending rate of 3 percent for two years, he would have $80,000 less at retirement (age 67) than if he had not borrowed.

Making Flexible Spending Accounts Better. There is something rather simple the Obama administration could do that would have a very large impact on health care spending. Apparently, this is something that can be done administratively, without Congressional action. The simple step: Allow deposits to Flexible Spending Accounts (FSAs) to roll over at year end and grow tax-free.

Currently, there are about 25 million people with an HSA or HRA account (roughly evenly split) and another 35 million people with FSAs. That means that over half the people with a health account have an incentive to spend rather than to save. If FSAs could roll over and become use-it-or-save-it accounts:

- There would be a huge immediate impact on the incentives of the 35 million current account holders; instead of end-of-year wasteful spending, they would be tempted to save for more valuable future health care spending.

- Employers across the country would consider integrating these accounts into their health plans, making employer contributions to them and experimenting with new health plan designs.

Moreover, employers and their employees would have a vehicle much better than any option currently available to them to control health care spending:

- FSAs could be combined with high deductibles, allowing employees to directly control, say, the first $2,500 of spending without all of the pointless restrictions that hamper the usefulness of HSAs.

- FSAs could be created to allow employees control of whole areas of spending, say, all preventive care and all diagnostic tests — services for which individual discretion is both possible and desirable.

- FSAs could be created for the chronically ill — allowing, say, diabetics or asthmatics to manage their own health care dollars, much as home-bound, disabled Medicaid patients manage their own budgets in the Cash and Counseling programs.

- FSAs could be combined with value-based purchasing insurance plans — where the insurer only pays, say, for certain drugs, doctors and hospitals, but allows patients to add money out-of-pocket and make other choices — thus allowing the development of a real market for more expensive health care services.

The Potential Impact of High Deductibles. Every serious study that has ever been done on the subject has found that patients spend less on health care when they are spending their own money. The latest study by the RAND Corporation estimates that families with high deductible plans and Health Savings Accounts spend about 30 percent less than families with conventional insurance. And that’s with HSA plans designed by Congress. Think how much more effective the accounts could be if they were designed by the marketplace.

Achieving the Ideal. Finally, good as the idea of FSA rollovers is, it is still short of the ideal. For starters, people need to have the option to withdraw cash from their FSA and spend it on non-health care goods and services. Beyond that, we should consider more fundamental reform.

As the table above shows, today we have an array of account options — each with advantages and disadvantages when compared to each other. This reflects the complete lack of a public policy purpose. Why should the contribution limit be $3,050 for an HSA, $2,500 for an FSA and unlimited for an HRA? Why should people be able to withdraw cash from the HSA, but not from the FSA or HRA? Why are FSAs and HRAs flexible, while HSAs are not?

As noted, the ideal account is a flexible Roth HSA. The Roth account involves after-tax deposits and tax-free withdrawals. It is the account that is most compatible with subsidizing health insurance with lump sum tax credits — an approach advocated by Sen. John McCain and incorporated in the Coburn/Burr/Ryan/Nunes health reform bill.