Source: The Institute for Healthcare Consumerism

Question: If I asked you to point to the most obvious examples of wasteful health care spending, where would you direct me? This is a no brainer. There is nothing more wasteful than first-dollar health insurance coverage. Even deductibles as low as $1,000 or $1,500 are incredibly wasteful in many places. By that I mean that if you choose a higher deductible, the premium savings is greater than the additional expense you are exposed to. That means you can put some of the premium savings in the bank to cover the additional risk exposure (dollar-for-dollar) and still come out ahead.

Second question: When is the last time you saw an article in Health Affairs or any other health policy journal pointing out this obvious way to eliminate waste? My guess is that your answer is “never.” I’m sure you have seen articles about the hazards of high-deductible insurance. Why are the journals so reluctant to focus on the benefits?

Every serious study that has ever been done on the subject has found that patients spend less on health care when they are spending their own money. The latest study by the RAND Corporation estimates that families with high-deductible plans and health savings accounts spend about 30 percent less than families with conventional insurance. And that’s with HSA plans designed by Congress. Think how much more effective the accounts could be if they were designed by the marketplace.

Further, no patient group was harmed by the switch to high-deductible insurance — not even vulnerable populations. This echoes the earlier findings of the RAND Health insurance experiment more than 30 years ago.

In the 30-year period since the RAND experiment was conducted, a number of experiments — both within this country and abroad — have explored ways to create greater patient cost-sharing without encouraging people to forgo needed care. These include Medisave Accounts in Singapore (dating from 1984), medical savings accounts (MSAs) in South Africa (dating from 1993); and in the United States, an MSA pilot program (dating from 1996), the current health savings account (HSA) program (dating from 2004), health reimbursement arrangements (dating from 2002), and even cash accounts in Medicaid. Many of these experiments have been subjected to considerable academic scrutiny.

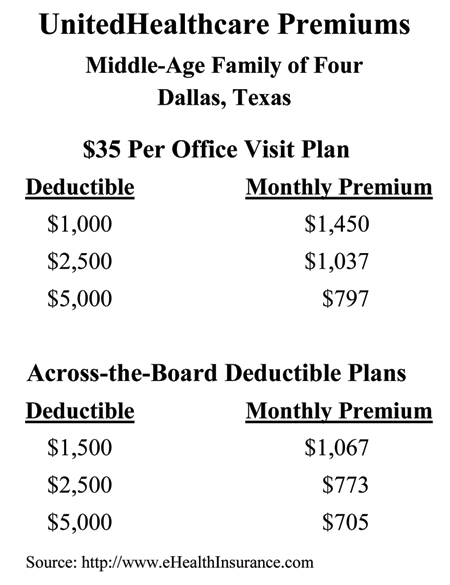

The table below shows the premiums charged by UnitedHealthcare for various policies for a middle-aged family of four in Dallas. Consider the first group of plans, with a $35 copay per office visit. The monthly premium for a family of four with a $1,000 per person deducible ($2,000 per family) is $1,450—or $17,400 per year.

In moving from a $1,000 annual deductible to a $2,500 deductible, the family is exposed to an additional risk of $1,500 per individual ($3,000 per family). (Note: The annual family plan deductible is twice the annual deductible per individual.) In return, they can save almost $5,000 a year in reduced premiums. In moving from a $1,000 to a $5,000 deductible, the family takes on an additional $4,000 of risk per individual (but no more than $8,000 per family). But the premium savings is nearly $8,000.

If you think about it, why would anyone buy the $1,000 deductible plan?

Gerry Musgrave and I discovered the same phenomena when we studied individual insurance premiums around the country two decades ago. At the time, I decided that as more people began to understand deductibles these oddities would disappear. I was wrong. If any reader can explain why these offers persist, please do so in the comments section.

Note: Dallas is a high-cost city and the savings from higher deductibles may not be as large in other areas. Also, the savings from higher deductibles are generally smaller for group insurance.