Source: Investor’s Business Daily

Marriage is on the decline, and some of that may be attributed to past and upcoming financial penalties from the federal government.

Marriage is on the decline, and some of that may be attributed to past and upcoming financial penalties from the federal government.

First marriages are occurring later in life – when they occur at all. In the past half-century cohabitation – living together prior to marriage or as a substitute for marriage – has increased 1,500%, according to a recent New York Times article.

Surveys show that about half of all women of childbearing age have lived with a romantic partner prior to marriage – a proportion that approaches nearly three-quarters of women in their 20s. The Pew Research Center found that nearly two-thirds of cohabitating partners view living together as a step toward marriage.

In the future, however, couples may skip the wedding bells altogether.

Social conservatives may lament this as a case of waning morality.Yet the reasons are partially economic: There are financial penalties in the tax code that kick in when couples get married.

There are additional penalties about to take effect under ObamaCare that further discourage couples from “tying the knot.”

The Patient Protection and Affordable Care Act (ACA) establishes health insurance exchanges where qualifying individuals can purchase subsidized, individual health insurance, starting in October 2013. However, the exchange subsidies are more generous to cohabitating partners than to married couples.

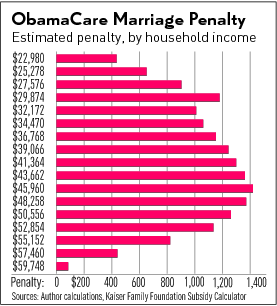

The ObamaCare marriage penalty creates perverse incentives that further discourage cohabitating couples from marriage – especially moderate-income couples.

The reason is health care subsidies to purchase coverage in the health insurance exchange are based on the federal poverty level, and the FPL does not rise proportionally with the number of individuals in the family.

For example, the poverty level is $11,490 for an individual, but increases to $15,510 for a married couple – only $4,020 more.

Because this poverty designation does not increase equally for each member of the family, two unmarried individuals living together qualify for larger federal subsidies than they would if they were married.

Consider two young college students living together, each earning 200% of the FPL (about $22,980 annually).

If that same couple were to marry, their combined household income of $45,960 would rise as a percent of the poverty level from 200% (individually) to 296% for a family of two.

As a result, their premiums in the health insurance exchange would be capped at a higher percentage of their income, providing a smaller total subsidy.

Instead of capping their premiums at no more than 6.3% of income as two individuals earning 200% of FPL, their premiums would be capped at 9.4% of income for a married family of two earning 296% of poverty. For example:

- Individually they would each qualify for a subsidy of about $1,087, or $2,174 per household.

- If that same couple were to marry, their combined subsidy would fall to $753.

- Thus, their marriage penalty is $1,421 annually.

Moreover, were this couple to have a child together, the Washington-based Tax Policy Center estimates this couple would suffer an additional penalty of $2,672 per year in higher taxes as a result of their decision to get married (although their ObamaCare exchange penalty would fall by $456).

It is a reasonable bet that $3,637 (the combined marriage penalty) is a large enough annual penalty to make many young couples living together hesitate about marriage.

The ObamaCare exchange marriage penalty is especially pronounced for moderate-income couples with combined incomes that fall between $30,000 and $55,000 annually.

National statistics already show that low- to moderate-income couples who cohabitate are about twice as likely to forgo marriage as couples with a bachelor’s degree. A similar proportion of all these couples ultimately break up and dissolve their union.

However, cohabitating leads to marriage far more often among more highly educated couples. That may be because the tax penalties take a bigger bite out of lower-income couples’ budgets, discouraging a trip down the aisle.

Research confirms that children benefit from the stability that marriage provides a family.

Yet, couples who cohabitate are more likely to raise children without the security of marriage. Government surveys find that about one in five women who begin cohabitating for the first time become pregnant within the first year. (For some demographics, this rises to 40%.)

The structure of the health care exchange subsidies will have perverse incentives on family formation. As a result of these and pre-existing marriage tax penalties, many moderate-income couples will decide marriage is a luxury they cannot afford.