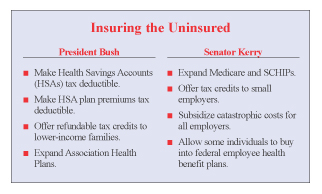

Now that the presidential nominees of both major parties are known, it is appropriate to focus attention on the candidates' plans to deal with the problem of insuring the uninsured. The differences are major. Senator John F. Kerry proposes spending 10 times as much as President Bush does on solutions to the problem. But because Kerry would scatter money over many programs rather than targeting spending toward those with the greatest need and focusing on the most effective programs, taxpayers would not get their money's worth in return for all this largesse.

Individuals versus Bureaucracies.

A significant part of President Bush's health agenda has already been signed into law. As of January 1, 2004, 250 million nonelderly Americans in principle can control some of their own health care dollars through personal health savings accounts (HSAs) that accompany high-deductible health insurance plans. HSA funds are used to pay for medical expenses directly, and amounts not spent grow tax free to finance future medical needs.

Although HSAs are primarily viewed as a way to empower patients and control costs, they also help reduce the number of uninsured. Internal Revenue Service records show that when these types of accounts became available as part of a pilot program, about 73 percent of those who took advantage of them were previously uninsured. Since Sen. Kerry opposes HSAs, presumably he favors the managed care approach of turning most health care dollars over to third-party payers.

Private versus Public.

Although Bush has called for an expansion of community health centers, his primary emphasis is on helping uninsured Americans obtain private health insurance coverage. He has proposed a tax credit of $1,000 per individual (up to $3,000 per family) to help low-income Americans buy their own health insurance. An estimated two to six million uninsured Americans will take advantage of these tax credits. Additionally, in his State of the Union message, the president called for an "above-the-line" tax deduction for insurance premiums for individually purchased HSA plans. This would provide tax relief similar to the tax subsidy for employer-provided insurance.

In contrast, the primary emphasis of Kerry's plan is the expansion of Medicaid and SCHIP (the state children's health insurance program). Virtually all uninsured children in households earning up to $55,000 would be eligible for one of the two programs, and their parents would be covered in households with incomes of less than $37,000 per year.

Currently, almost 14 million uninsured adults and children who qualify for these programs have not enrolled. Kerry would extend this opportunity to enroll to an additional 4 million. To prod people into accepting coverage, he proposes automatically enrolling children in public schools or when they use community health centers. Past experience suggests this will not be easy. (In the Parkland Hospital emergency room in Dallas, paid staffers fail to enroll Medicaid-eligible patients more than half the time!)

Targeted Versus Untargeted.

Bush's tax credits are targeted toward two groups:

- Those who are currently uninsured and

- Those who are currently discriminated against under the tax laws (see the discussion below).

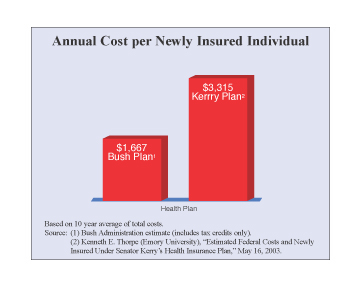

The Bush Administration estimates that the tax credit would cost $70 billion over 10 years and insure 4.2 million currently uninsured people. There is no estimate yet of the impact of Bush's proposed tax deduction. Most of the private insurance subsidies in Kerry's $895 billion package would go to employer plans rather than to individuals. Employers would be offered reinsurance, with government assuming 75 percent of all health care costs in excess of $50,000 per year per employee – if the employer offers insurance to all employees and picks up a share of the premium costs. Small businesses would receive a tax credit of up to 50 percent of the cost of premiums for low-income employees – even those who are already insured. Even Kerry estimates that most of the spending will be on people who are already insured. We estimate that the reinsurance provision will cost more than $10,000 per year for each newly insured person, on the average!

Kerry would also allow some people to join a pool similar to the Federal Employee Health Benefit Program (FEHBP) . Low-income and unemployed persons would qualify for subsidies. Older individuals would be charged "actuarially fair" premiums.

Like Kerry's plan for employer-provided insurance, his expansion of Medicaid and SCHIP is also very expensive, relative to what it achieves. The reason is that people tend to drop their private coverage to enroll in taxpayer funded insurance. In fact, studies estimate that 50 cents to 75 cents of each additional dollar spent under Medicaid simply replaces private insurance coverage.

Emory University health policy analyst Kenneth Thorpe, an adviser to Democratic presidential candidates, estimates that if all 27 million individuals who qualify under Kerry's proposals were enrolled, the cost per newly insured individual would be $3,315 or about $10,000 for a family of three.

Expensive as this is, the estimate is far too optimistic.

Portable versus Employment-Based Insurance.

In addition to the two tax subsidy proposals, Bush supports expansion of Association Health Plans (AHPs). This would allow groups such as the National Restaurant Association to sell insurance to their members in all 50 states. All three of these proposals would encourage individually-owned personal and portable health insurance. By contrast, Kerry is mostly focused on employer-provided insurance – the kind that must be forfeited every time a worker changes jobs. Granted, people who are able to buy into the plans similar to the FEHBP will have individually owned insurance, but this insurance has some of the same disadvantages as employer-sponsored coverage. For example, the insurance lasts only 12 months at a time and the ability to participate anew vanishes if an individual's eligibility changes.

Tax Fairness versus Discrimination.

Current tax law favors health insurance purchased through employer-sponsored plans by excluding employers' premium contributions from their employees' taxable income. By contrast, individuals who purchase their own insurance (other than the self-employed) get virtually no tax relief. Bush proposes to create a level playing field by giving individually purchased HSA plans the same tax advantages as policies purchased through an employer. Sen. Kerry has ignored this issue.

Conclusion.

Overall, Kerry's plan is much more ambitious – spending 10 times as many taxpayer dollars and trying to insure more of the uninsured. But under his program, taxpayers will pay a lot more than what insurance costs in the marketplace. Based on Kerry's health adviser's estimate, the Kerry proposal costs twice as much as Bush's per newly insured. Under more realistic assumptions, Kerry's plan may cost four, five or six times more than Bush's.

Devon M.Herrick, Ph.D., is a senior fellow at the National Center for Policy Analysis.