Public officials and health care experts have recently suggested a number of reforms to reduce the cost of individual health insurance. However, most of the proposals fail to address the contribution of mandated benefits to the high cost of insurance in many states.

Problem: Excessive State Mandates Increase Costs. Differing regulations and mandates among the states cause wide variations in individual health insurance rates. The federal McCarran-Ferguson Act, which lets states set their own requirements for coverage, has protected state markets from competition, and led to an assortment of mandates — many of which the insured do not want or need. For example:

- About one-fourth of states require health insurance to cover acupuncture and marriage counseling.

- More than half of states require coverage for social workers and 60 percent mandate coverage for contraceptives.

- Seven states require coverage for hairpieces and nine for hearing aids.

In all, there are more than 1,900 state mandates across the United States. Some legislators contribute to this excess by giving in to special interest demands that insurers cover their specific services and providers. The result is higher premiums for consumers — pricing an estimated one-fourth of the uninsured out of the market.

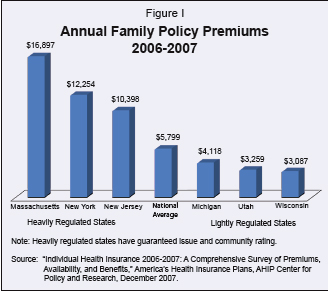

Problem: No National Market for Insurance. Although most insurers operate in multiple states, their plans must be tailored to each state's specific requirements. As a result, there is no competitive national market for individual health insurance. Instead, there are fragmented markets and large price differences [see Figure I]:

Problem: No National Market for Insurance. Although most insurers operate in multiple states, their plans must be tailored to each state's specific requirements. As a result, there is no competitive national market for individual health insurance. Instead, there are fragmented markets and large price differences [see Figure I]:

- A family purchasing a health insurance policy in Wisconsin would pay about $3,087, but that policy would cost $10,398 in New Jersey.

- A similar policy in Utah would cost $3,259, compared to $12,254 in New York.

- A family policy in Michigan would cost $4,118, but an astronomical $16,897 in Massachusetts.

Thus, the difference in premiums is largely the result of state mandates that inhibit the creation of a national market, not regional variations in health care costs.

Wrong Solution: More Regulation. Recent proposals advocating universal care — including those of Democratic presidential candidate Barack Obama and legislators in California, Illinois and Pennsylvania — include two regulations that have consistently been shown to raise health care costs: guaranteed issue and community rating.

Guaranteed issue means that insurance companies offering policies must sell coverage to all who apply, regardless of medical condition. While this sounds like it protects consumers, it actually harms them. For example, in Massachusetts and New Jersey it has driven up premiums. When insurance companies are forced to accept all applicants, they raise premiums to guard against losses. As a result, health insurance becomes a poor value for everyone except those with serious health conditions. Business dwindles as demand decreases, insurers leave the market and rates increase even more from a lack of competition. This pattern has occurred in every state that requires guaranteed issue.

Community rating means that insurers cannot adjust premiums to reflect the individual health risks of consumers. When everyone pays similar premiums, healthy people are charged more than they otherwise would be and sick people are charged less. Therefore, premiums rise for the majority who are healthy. Because of the higher cost, younger (or lower-income) individuals with few health problems tend to drop insurance, leaving an increasingly unhealthy risk pool. This drives premiums even higher — and fewer and fewer people can afford coverage.

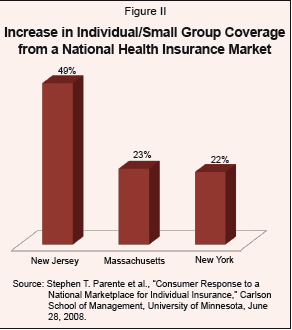

Right Solution: Interstate Competition. Rep. John Shadegg (R-Ariz.) has proposed interstate competition at the federal level with the Health Care Choice Act (H.R. 4460). The bill would allow consumers to shop for individual insurance on the Internet, over the telephone or through a local agent. Residents of any state would be free to choose among policies from insurers in any state. The policies would be regulated by the insurer's home state. If consumers do not want expensive health plans that pay for benefits they do not need — such as acupuncture, fertility treatments or hairpieces — they could buy from insurers in states that do not mandate such benefits. With interstate competition, consumers would be more likely to find a policy that fits their budget, giving more people access to affordable insurance. This is consistent with a recent University of Minnesota study that found approximately 12 million additional people would be covered if health coverage could be purchased in a competitive national marketplace. Highly regulated states would benefit most (see Figure II).

Right Solution: Interstate Competition. Rep. John Shadegg (R-Ariz.) has proposed interstate competition at the federal level with the Health Care Choice Act (H.R. 4460). The bill would allow consumers to shop for individual insurance on the Internet, over the telephone or through a local agent. Residents of any state would be free to choose among policies from insurers in any state. The policies would be regulated by the insurer's home state. If consumers do not want expensive health plans that pay for benefits they do not need — such as acupuncture, fertility treatments or hairpieces — they could buy from insurers in states that do not mandate such benefits. With interstate competition, consumers would be more likely to find a policy that fits their budget, giving more people access to affordable insurance. This is consistent with a recent University of Minnesota study that found approximately 12 million additional people would be covered if health coverage could be purchased in a competitive national marketplace. Highly regulated states would benefit most (see Figure II).

Other Needed Reforms. Insurers should be allowed to experiment with innovative products like limited benefit plans, often known as “mini med” plans, which generally provide coverage for a limited number of physician visits each year, a limited amount of inpatient care and sometimes coverage for prescription drugs. Other reforms, such as mandate-free policies that take advantage of cross-border providers, would also provide consumers with a greater range of options.

Conclusion. Protection from interstate competition allows lobbyists to impose expensive mandates. Allowing residents to purchase coverage across state lines would create more competitive insurance markets. In addition, letting insurers experiment with different designs to create innovative and cost-effective health plans will decrease the number of people who cannot afford care.

Devon Herrick is a senior fellow and Ariel House is a junior fellow with the National Center for Policy Analysis.