Globalization and capital mobility are increasing tax competition among countries. Lower tax rates increase after-tax returns to capital, raising economic growth rates. They can also make economies more attractive for foreign investment. Furthermore, lower taxes on capital are generally associated with increased government tax revenues.

Thus, countries around the world have been cutting taxes on income from capital, such as personal income taxes on capital gains and dividends, and the corporate income tax levied on profits. These countries are reaping the benefits of increased business investment and economic growth. In recent years, the United States has reduced some taxes on capital, but high corporate income tax rates are hurting its ability to compete for capital. The result is less investment and lower wages than would otherwise have been the case. The United States should follow Europe and the rest of the world and cut its burdensome corporate income tax.

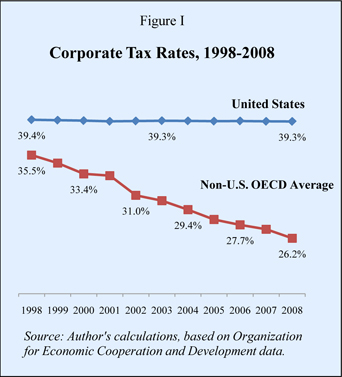

High U.S. Corporate Tax Rates. The United States has the second highest total corporate income tax rate of any developed country. In 1986 President Ronald Reagan cut the corporate income tax rate from 43 percent to 34 percent, significantly improving America's competitive advantage over high-tax countries. In 1993 President Clinton raised the corporate income tax rate 1 percentage point, which brought the federal tax rate to 35 percent, where it remains today. However, including average state corporate taxes, the combined total U.S. corporate income tax rate is 39.25 percent, second only to Japan's 39.54 percent. In contrast, the average corporate tax rate of industrialized countries in the Organization for Economic Cooperation and Development (OECD) was 27.6 percent in 2007 [see Figure I] and is due to fall even further.

Less Investment. Investment is very sensitive to corporate tax rates. Globalization makes it increasingly easier to move capital across national borders, and investors generally seek lower tax jurisdictions. Some developing nations have cut corporate tax rates to attract foreign investment from developed countries. Analyzing U.S. state corporate tax rates, Claudio Agostini of Georgetown University found that every 1 percentage-point increase in the corporate tax rate reduces foreign direct investment by roughly 1 percent.

Less Investment. Investment is very sensitive to corporate tax rates. Globalization makes it increasingly easier to move capital across national borders, and investors generally seek lower tax jurisdictions. Some developing nations have cut corporate tax rates to attract foreign investment from developed countries. Analyzing U.S. state corporate tax rates, Claudio Agostini of Georgetown University found that every 1 percentage-point increase in the corporate tax rate reduces foreign direct investment by roughly 1 percent.

Lower Wages. High U.S. corporate tax rates also depress wages domestically. By raising the cost of capital for firms, corporate taxes reduce the demand for capital. Subsequently, lower capital investment tends to reduce capital per worker, making workers less productive and forcing companies to cut real wages as lower productivity results in fewer profits. For instance:

- Workers bear slightly more than 70 percent of the burden of high corporate taxes in the form of reduced wages, estimates the Congressional Budget Office.

- A $1 increase in corporate taxes tends to reduce real median wages by 92 cents, concludes an Oxford University study.

- A 1 percentage-point increase in corporate tax rates is associated with nearly a 1 percent drop in wage rates, according to an American Enterprise Institute (AEI) study.

Economists caution that people ultimately pay taxes, not corporations. Thus, corporate tax hikes unintentionally hurt workers.

Lower Tax Revenues. Because they contribute to capital flight, high corporate tax rates also lower government revenue. With increasing capital mobility, multinational firms respond to higher taxes by moving activities to lower tax jurisdictions. This capital flight means fewer taxes are paid domestically. In fact, governments frequently find that at a higher rate the tax actually raises less revenue. This finding adds support for the Laffer Curve.

The insight behind the Laffer Curve is that if a tax rate is high, a government can raise the same amount of revenue (or more) by lowering the tax rate. Most countries have found that tax revenues rise following cuts in their corporate tax rates.

For example:

- The average corporate income tax rate worldwide fell from 46 percent to 33 percent between 1982 and 1999, while corporate income tax collections rose from 2.1 percent to 2.4 percent of national income, reports the Cato Institute.

- Similarly, the average corporate tax rate in 19 OECD countries fell from 45 percent in 1985 to 29 percent by 2005, while corporate tax revenues soared from 2.6 percent to 3.7 percent of gross domestic product (GDP).

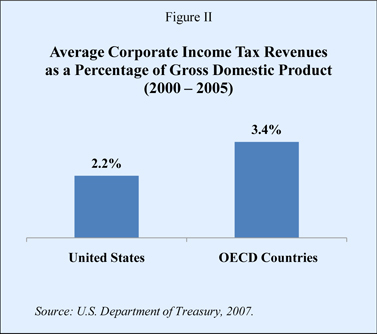

- Over the 2000 to 2005 period, according to the U.S. Treasury Department, average corporate income tax revenue as a percentage of GDP was one-third greater in OECD countries (3.4 percent) than in the United States (2.2 percent). [See Figure II.]

The revenue-maximizing corporate tax rate in developed countries was about 34 percent in the late 1980s and has declined steadily to about 26 percent in recent years, estimate Alex Brill and Kevin Hassett of AEI. Thus, at 39.25 percent, the U.S. corporate tax rate is not only high but also inefficient in producing revenue.

Conclusion. High corporate taxes reduce economic growth and job creation by lowering investment and wages. They also tend to produce less tax revenue. While cutting the corporate tax rate is only one aspect of spurring economic growth, it is an essential step. Lowering the U.S. corporate tax to less than the average OECD level of 27 percent will ensure that United States does not continue to fall behind the rest of the world.

Mehreen Younis is a research assistant with the National Center for Policy Analysis.