Congress is facing a tax deadline. Under legislation passed in 2001, the federal estate tax is being phased out: The tax rate is falling and the value of the property of the deceased that is exempted from the tax is rising. The tax is scheduled to disappear in 2010, but it will return in 2011 at pre-2001 rates – up to 55 percent for estates valued in excess of $1 million. The Senate voted in April 2009 to reduce the rate of the revivified tax to 35 percent, but the House of Representatives has not acted.

Support for the estate tax is based on three major claims: 1) inheritances are a major source of wealth inequality, 2) the tax provides significant revenue for the federal government and 3) the individuals required to pay the tax can easily afford it. These are myths, however. Not only the rich, but lower- and middle-class Americans, especially small business owners, should be concerned if the tax is not repealed.

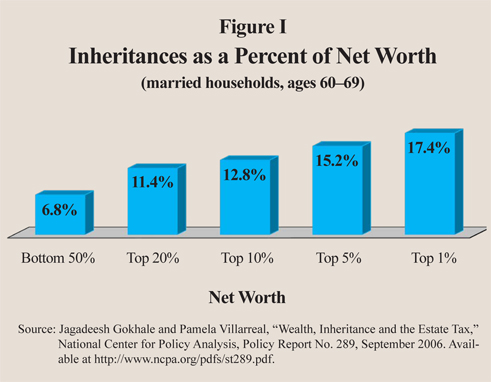

Myth: Major Source of Inequality. Support for the estate tax is based largely on the idea that inheritances are a major source of wealth inequality. However, an NCPA analysis of data from the 2004 Survey of Consumer Finances found that among the wealthiest 1 percent of Americans only 17 percent of their wealth came from bequests. [See Figure I.]

Myth: Significant Revenue for Federal Government. Estate tax advocates claim that it raises considerable sums for the federal government. In reality, the tax makes up less than 3 percent of total federal tax proceeds. Moreover, it reduces capital formation, thereby lowering productivity, wages, employment, and federal payroll and income tax revenues. The Heritage Foundation found that as a result of complete estate tax repeal:

- The U.S. economy would average as much as $11 billion per year in extra output.

- An average of 145,000 new jobs per year could be created and personal income could rise by an average of $8 billion annually above current projections.

- The federal budget deficit would decline because increased revenue generated by increased economic growth would more than compensate for estate tax revenue.

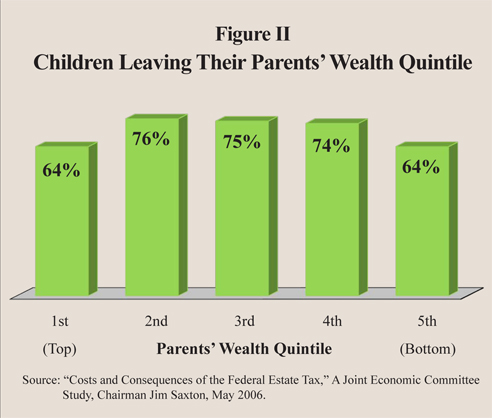

Myth: Heirs Can Afford the Tax. Proponents maintain that the estate tax is paid only by those who can easily afford it. However, heirs may be wealthy or poor. In fact, nearly two-thirds of the children of parents in the wealthiest 20 percent of families fall to a lower wealth bracket upon reaching adulthood. [See Figure II.]

Reality: Heirs Can Be Asset Rich, but Cash Poor. Contrary to these notions, middle-class Americans, especially small business owners, can be stuck with an estate tax burden. For example:

- Peter Bowler and his family lost everything when, faced with a $4 million tax bill on an estate previously valued at $10 million, they were forced to sell his father's 28-year-old Rhode Island freight business following the 1987 stock market crash.

- Clayton Leverett's father began paying the estate tax in installments upon inheriting the family ranch, but when his father died Clayton began making two payments, with interest, to the IRS: one for the tax due on his father's estate and one for the tax on his grandparents' estate. He will be making regular tax payments for 15 years.

- A typical tree farm can be valued at more than $2 million, according to Douglas Stinson, a tree farmer from Washington state – but because the household income of an average tree farmer is less than $50,000, many heirs must sell their land to pay the estate tax.

A survey by the Center for the Study of Taxation found that because of the estate tax, 51 percent of family businesses would have significant difficulty surviving a principal owner's death. Fourteen percent of business owners said it would be impossible for them to survive and only 10 percent said the estate tax would have no effect.

A survey by the Center for the Study of Taxation found that because of the estate tax, 51 percent of family businesses would have significant difficulty surviving a principal owner's death. Fourteen percent of business owners said it would be impossible for them to survive and only 10 percent said the estate tax would have no effect.

Conclusion. Small business owners and other middle-class Americans must not be deceived by the misleading claims of estate tax supporters. Even if the tax is allowed to go away in 2010, the increase when it returns in 2011 will only further impede productivity. If Congress truly wants to stimulate the economy, they ought to end the estate tax permanently.

Terry Neese is a distinguished fellow and Bethany Lowe is a research assistant with the National Center for Policy Analysis.