Congress is considering establishing a new agency to regulate consumer financial products and services – everything from home equity loans to credit cards to pawnshops.

Under legislation sponsored by Representative Barney Frank (D-Mass.), a new Consumer Financial Protection Agency would assume functions now performed by a host of other federal agencies, such as the Federal Trade Commission, the Federal Deposit Insurance Corporation and the Comptroller of the Currency. Senator Chris Dodd (D-Conn.) has included similar provisions in a more comprehensive bill overhauling federal regulation of banks and other financial institutions.

The consumer agency would be directed by a four-member board appointed by the president and confirmed by the Senate. Each member would serve a five-year staggered term and could only be removed for cause. Thus, the agency would be independent, similar to the Interstate Commerce Commission, and only indirectly accountable to the president.

The consumer agency would be directed by a four-member board appointed by the president and confirmed by the Senate. Each member would serve a five-year staggered term and could only be removed for cause. Thus, the agency would be independent, similar to the Interstate Commerce Commission, and only indirectly accountable to the president.

Many believe excessive consumer lending on terms unfavorable to debtors exacerbated the 2008 financial crisis and current recession. Thus, Congress is seeking to tighten regulations by consolidating authority into one agency charged with preventing "unfair, deceptive or abusive acts or practices" in the consumer financial services industry.

However, increased federal control over consumer credit could have the unintended consequence of reducing the access of small businesses to important sources of financing.

Problem: Small Businesses Rely on Personal Credit. Small businesses are generally private corporations, partnerships or sole proprietorships and can range in size from a self-employed individual with no employees to 500 employees. Many have difficulty accessing commercial credit (bank loans) because of their size or lack of credit history. Unlike public corporations, they do not have access to equity (stock and bond) markets. Their high failure rate makes them a risky investment for lenders – nearly 12 percent of Small Business Administration-backed loans went into default in 2008.

Therefore, in lieu of or to supplement business credit, most of the 29.6 million small businesses in the United States use owners' consumer credit – personal debts, including credit cards or home equity credit lines. Indeed:

Therefore, in lieu of or to supplement business credit, most of the 29.6 million small businesses in the United States use owners' consumer credit – personal debts, including credit cards or home equity credit lines. Indeed:

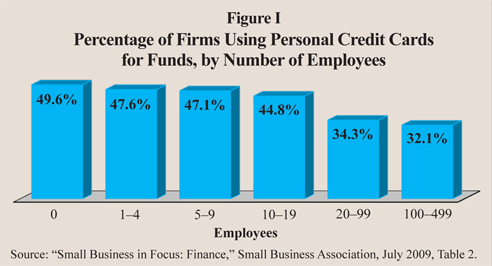

- In 2003, according to the Federal Reserve Board's most recent Survey of Small Business Finance, almost half of all small businesses used a personal credit card for funds. [See Figure I.]

- The 2008 National Federation of Independent Business survey reported more than a quarter of small employers who own their personal residence took out a mortgage to provide capital for their business.

- In addition, 10 percent of small employers used their home as collateral to purchase other business assets.

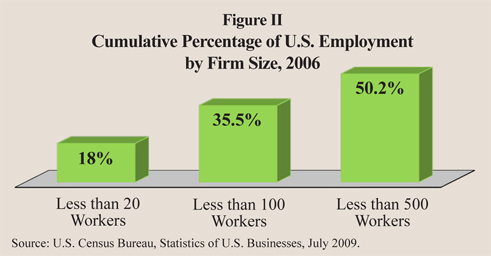

The ability of small businesses to borrow has significant implications for the economy, because they employ a substantial portion of all workers and are responsible for the creation of most new jobs. According to the U.S. Census Bureau, firms with fewer than 100 employees accounted for more than 35 percent of U.S. employment in 2006. [See Figure II.] The Small Business Administration states that over the past 15 years small businesses have generated 64 percent of net new jobs.

Problem: Increased Regulation Would Raise Borrowing Costs. The new agency is expected to issue regulations standardizing the terms of loans and other financial products. This would leave little room for competition or innovation among lenders. In addition, borrowers would have to meet creditworthiness standards dictated by the agency. This could cut off access to credit for many firms and raise borrowing costs for the rest. According to conservative estimates by law professors at George Mason University and the University of Chicago:

- Federal credit regulations could increase consumer interest rates by more than 1.6 percentage points, on the average.

- Consumer borrowing would be reduced by at least 2.1 percent.

- Net new job creation would fall 4.3 percent.

Problem: Regulatory Uncertainty. The agency would regulate all forms of consumer credit, including products and services that are already regulated by individual states. If the agency believed a state law did not meet its standard for consumer protection, it would have the authority to preempt that law. The result would be a confusing mix of federal and state regulations.

Furthermore, the agency would ban allegedly abusive lending practices in addition to unfair and deceptive ones. While there is relative certainty about what unfair and deceptive practices are based on case law, there is no certainty regarding what constitutes abusive practices. Lenders will not know whether their practices will be allowed under the new regulations. Thus, they will incur larger costs for legal advice and litigation – which will inevitably be passed on to small businesses and consumers, further restricting access to credit.

Conclusion. The proposed Consumer Financial Protection Agency would make it more difficult for lenders to offer services and products that are important to small businesses. At a time when the economy is still struggling to recover, the last thing Congress ought to consider is an additional layer of regulation that could discourage new job creation.

Terry Neese is a distinguished fellow and Bethany Lowe is a research assistant with the National Center for Policy Analysis.