A proposal to allow 55- to 64-year-olds to buy Medicare coverage is gaining traction in the Senate deliberations on health care reform. What will this mean for Medicare's finances? How much will it cost to buy the coverage? How will this expansion affect the labor force participation of older Americans?

How Much Will It Cost to Buy Into Medicare? Proponents of the change say that new enrollees will be charged a premium that reflects the total cost they will add to the Medicare program. Since Medicare often pays providers less than private payers, Medicare premiums could be lower than private insurance premiums in principle. However, Medicare coverage is less complete than what most Americans expect from health insurance. That is why so many seniors pay a second premium for Medigap insurance. Unless this Medicare expansion is heavily subsidized the odds are that very few uninsured near-elderly will opt in.

How Much Will It Cost to Buy Into Medicare? Proponents of the change say that new enrollees will be charged a premium that reflects the total cost they will add to the Medicare program. Since Medicare often pays providers less than private payers, Medicare premiums could be lower than private insurance premiums in principle. However, Medicare coverage is less complete than what most Americans expect from health insurance. That is why so many seniors pay a second premium for Medigap insurance. Unless this Medicare expansion is heavily subsidized the odds are that very few uninsured near-elderly will opt in.

If Medicare Coverage Is Subsidized, Will the Currently Insured Near-Elderly Drop Their Private Insurance to Enroll? As of 2008, 12.5 percent of 55- to 64-year-olds were uninsured, representing less than 10 percent of all uninsured. To induce this uninsured group to voluntarily buy into Medicare, the premiums would have to be subsidized in some way. But these subsidies would also make Medicare attractive for those who currently purchase their own private insurance.

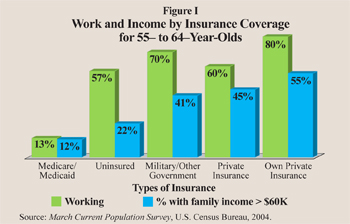

Are the Uninsured Near-Elderly More Likely to be Unemployed or to Have Low Family Incomes? How does the labor market activity of the uninsured members of the targeted age group differ from those who have insurance coverage? Figure I shows how labor force participation and family income vary by type of insurance coverage for the 55 to 64 population. Among the uninsured in this age group, about 57 percent are in the workforce and 22 percent have family incomes of $60,000 or more. More of those who purchase their own insurance work and they have higher earnings, but they account for just over 7 percent of the targeted population. The 60 percent of this age group covered by private employer-based insurance have the highest labor market participation rate – almost 80 percent – and 55 percent are in families with income of at least $60,000.

Are the Uninsured Near-Elderly More Likely to be Unemployed or to Have Low Family Incomes? How does the labor market activity of the uninsured members of the targeted age group differ from those who have insurance coverage? Figure I shows how labor force participation and family income vary by type of insurance coverage for the 55 to 64 population. Among the uninsured in this age group, about 57 percent are in the workforce and 22 percent have family incomes of $60,000 or more. More of those who purchase their own insurance work and they have higher earnings, but they account for just over 7 percent of the targeted population. The 60 percent of this age group covered by private employer-based insurance have the highest labor market participation rate – almost 80 percent – and 55 percent are in families with income of at least $60,000.

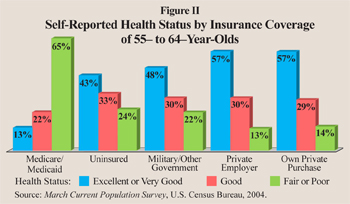

Are the Uninsured Near-Elderly More Likely to Be in Poor Health? The uninsured among the 55- to 64-year-old population is the target of the proposed Medicare extension. Those who are less healthy may not be able to find affordable health insurance. Figure II compares the health status of this age group by insurance coverage:

- Individuals with employer-provided or self-purchased health insurance report the best health, while 64 percent of those covered by Medicare and/or Medicaid report fair or poor health.

- By contrast, 76 percent of the uninsured people in this age group report that their health is good, very good or excellent, and 24 percent report fair or poor health.

Thus, the evidence suggests that uninsured older Americans are not uniformly in low-income families nor are they uniformly in poor health.

Will Subsidized Medicare Insurance Induce the Near-Elderly to Drop Out of the Labor Market? An unintended consequence of the proposed change is its impact on the labor force participation of the 23 million baby boomers between 55 and 64 who currently work. While health insurance coverage should be portable from job to job, the lack of portability because of the present tax treatment of health insurance appears to influence the timing of retirement:

- Social Security's early retirement age is 62 and 40 percent start claiming benefits at this age.

- But there is a second spike at 65, the age of eligibility for Medicare, when 34 percent join the Social Security rolls.

This suggests that many older Americans continue to work until they are eligible for Medicare benefits.

Could the New Program Add to Medicare's Unfunded Liabilities? Given that a significant portion of individuals wait to claim Social Security until they are also eligible for Medicare, the structure of the new reform, particularly the subsidy rate, will determine how many workers will exit the labor force if their continued work is not required for health care coverage. Such a drop in labor force participation will reduce both tax revenue and output. The ultimate costs of the reform are therefore more than just the subsidy per capita multiplied by the number of people who buy into Medicare. Further, subsidy rates in Medicare have a history of growing. Initially, Medicare's Part B premiums paid by enrollees were to cover 50 percent of the program's costs and taxpayers were to subsidize the other 50 percent, but within 17 years of Medicare's passage taxpayers were subsidizing 75 percent of the cost. However the cost is accounted for, this Medicare expansion would likely add to the program's unfunded liabilities.

Conclusion. These are some of the foreseeable consequences of extending Medicare to the 55- to 64-year-old population. If the proposal does not include generous subsidies, the uninsured probably won't find it attractive. However, even without subsidies it may induce some current workers to retire early. But if the proposal does include large enough subsidies that make it attractive for the uninsured to voluntarily buy-in, then the costs of covering the uninsured will rise. In addition, the subsidized Medicare will make early retirement much more attractive for the currently insured working population. Thus the expansion of Medicare to the 55- to 64-year-old population is likely to be expensive and counterproductive.

Andrew J. Rettenmaier and Thomas R. Saving are executive associate director and director, respectively, of the Private Enterprise Research Center at Texas A&M University and senior fellows with the National Center for Policy Analysis.