People have a great deal of control over whether or not their retirement will be comfortable. Millions of Americans are preparing for retirement by saving in tax-favored retirement accounts – principally Individual Retirement Accounts (IRAs) and employer-sponsored 401(k) plans. But savers must be aware of common practices that can derail even the best-laid retirement plans.

In fact, there are 10 surefire ways people can wreck their retirement.

1. Don't Make Saving a Habit. Young workers may think they have plenty of time to save later, but setting aside a little bit of money on a regular basis throughout one's working years produces a greater nest egg than setting aside a large amount later on.

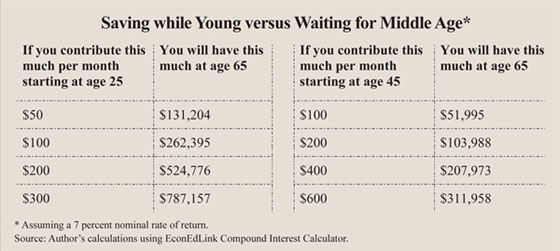

For instance [see Table I]:

- A 25-year-old who puts away $100 a month for 40 years at a 7 percent nominal interest rate will have more than $260,000 by age 65.

- However, if the employee waits until age 45, doubling his contributions to $200 a month will yield a balance of only $104,000 by age 65.

Procrastination can significantly reduce potential retirement savings.

Procrastination can significantly reduce potential retirement savings.

2. Leave Matching Funds on the Table. Not taking advantage of an employer's matching contributions to a 401(k) account is like turning down a raise. An employee who turns down a dollar-for-dollar 401(k) account match of up to 5 percent of his salary is passing up a 5 percent bonus paid with untaxed dollars. For example, an employee earning $50,000 a year who is eligible for a dollar-for-dollar match of up to 5 percent of salary could receive $2,500 in extra compensation by contributing the maximum amount eligible for the match.

3. Borrow against 401(k) Savings. About 85 percent of 401(k) plans allow employees to borrow against their account balances. The problem with a 401(k) loan is the loss of compound interest and dividends that would have accrued if the money had not been borrowed. An employee with a $50,000 account balance who borrows $25,000 at least 30 years prior to retirement would lose more than $950 per month in retirement income – for the rest of his life!

4. Cash Out 401(k) Savings. Cashing out a 401(k) account when changing jobs means that more than one-third of the balance can be eaten up in taxes and penalties. Consider a 25-year-old single male employee with no children earning $32,000 a year with a $20,000 401(k) balance. If he leaves his job and does not roll the account into a qualified retirement plan, such as an IRA, he will pay roughly $6,500 in taxes and penalties. Taxes and penalties are worse for older employees, who are likely in a higher income tax bracket.

5. Jump In and Out of the Market. In 2008, 401(k) plans lost an estimated $2 trillion in value. But this "loss" would have been on paper only were it not for the fact that many workers essentially locked in their losses by selling their equity funds during the recent downturn. Investors who don't have a proven strategy for getting out of the market and back in often move too late – selling low and buying high. This is a recipe for lagging returns, if not financial ruin.

6. Rely on Home Equity. Purchasing a home and selling it years down the road does not always produce a significant profit on which to retire. Even before the housing bubble burst, the average home was a mediocre investment. One dollar invested in stocks in 1963 would have grown to $12.36 by 2006, while the same dollar invested in a house would have grown to only $1.79.

7. Do Not Diversify Savings. Relying on one type of investment is a recipe for disaster. It is important to consider diversifying among asset types (stocks, bonds, money market funds), as well as diversifying within each type of asset (rather than holding one company's stock or one type of bond).

8. Underestimate Longevity. More people are living longer. This means that retirees should have strategies to ensure they don't outlive their money, including working past retirement age, annuitizing retirement account money and staying at least partially invested in stocks.

9. Ignore Inflation. When a household's income, combined with half of their annual Social Security benefits, exceeds a certain threshold, a portion of their Social Security benefits are subject to federal income taxes. The thresholds are not indexed. Over time, inflation pushes more and more retirees into the income range where they must add 50 cents of benefits to their taxable income for every dollar their income exceeds the threshold. This means their marginal tax rate will be 50 percent higher!

10. Stay in Debt. According to the 2007 Survey of Consumer Finances (the most recent available):

- Among preretirement adults ages 55 to 64, more than 80 percent had some type of debt – including mortgage or other residential property, credit card debt, lines of credit or installment loans – up from 70.8 percent in 1989.

- Among seniors ages 65 to 74, about 65 percent have debt, compared to less than 50 percent in 1989.

- And among seniors age 75 and older, 31.4 percent have debt, almost double the percentage in 1989.

Entering retirement debt-free is essential to being able to maintain a comfortable standard of living.

Conclusion. There are many more ways to damage one's retirement, and even the best-laid plans can be derailed by unforeseen events. But uncertainty alone is no reason to not plan at the household level, which is where everyone who wants a secure retirement must begin.

Pam Villarreal is a senior policy analyst with the National Center for Policy Analysis. This article is based on NCPA Policy Report No. 320.