Both the House and Senate health reform bills would establish exchanges offering people health insurance policies. Low-income individuals and families who did not have employer-provided health insurance and obtained coverage through an exchange would be eligible for subsidies. In both bills, the subsidies phase out with income, although the specific numbers differ.

Thus, observations about the House bill also apply, with slightly different numbers, to the Senate version.

Under the House bill, families with incomes up to 400 percent of the poverty level would be eligible for a subsidy. Income would be measured by a slightly modified adjusted gross income (AGI), and the subsidies would begin in 2013. For a person at 133 percent of the federal poverty level, the subsidy would limit premiums for a basic exchange plan to 1.5 percent of AGI and cap out-of pocket expenses (cost sharing) at $500. By 400 percent of the poverty level, the subsidy would limit the individual's premiums for a basic plan to 12 percent of AGI and cap out-of-pocket expenses at $5,000. People with higher AGIs would receive no subsidy.

Under the House bill, families with incomes up to 400 percent of the poverty level would be eligible for a subsidy. Income would be measured by a slightly modified adjusted gross income (AGI), and the subsidies would begin in 2013. For a person at 133 percent of the federal poverty level, the subsidy would limit premiums for a basic exchange plan to 1.5 percent of AGI and cap out-of pocket expenses (cost sharing) at $500. By 400 percent of the poverty level, the subsidy would limit the individual's premiums for a basic plan to 12 percent of AGI and cap out-of-pocket expenses at $5,000. People with higher AGIs would receive no subsidy.

Marginal Tax Rate Spikes. Subsidy phaseouts create tax rate spikes. Because the subsidy would be withdrawn as an individual's income rose, its loss is equivalent to a tax on additional earnings within the phaseout range. Both the tax and the marginal rate would be extremely high because the subsidy would initially be very large. The Congressional Budget Office (CBO) estimated the subsidies at seven income levels in 2016, from which implicit marginal tax rates due to the phaseout may be calculated.

For example, the CBO estimates that a family of four with an income of $54,000 (about 225 percent of the poverty level) would receive a health exchange subsidy of $14,300. The subsidy would drop to $10,500 as the family's income rose to $66,000. The $3,800 subsidy loss over a $12,000 income range would generate an implicit marginal tax rate of 31.67 percent.

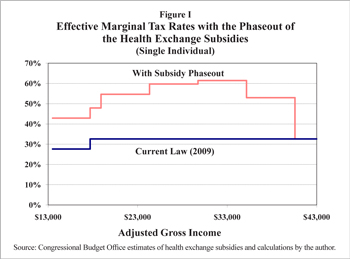

Marginal Tax Rates on Individuals. Figure I shows the impact of the subsidy phaseout on single individuals below 400 percent of the poverty level who buy their own insurance through a health insurance exchange. The lower line is based on current law, and includes federal income and payroll (OASDI) taxes, and state income tax. The combined marginal tax rate is 27.6 percent for individuals in the 10 percent federal income tax bracket, rising to 32.6 percent in the 15 percent tax bracket and 42.6 percent in the 25 percent bracket.

The upper line adds the implicit marginal tax rate due to the phaseout of the health exchange subsidy. Throughout the subsidy phaseout range, the combined marginal tax rate is over 40 percent. It is well above 50 percent across most of the range, and it is close to or above 60 percent for individuals with incomes between about $24,000 and $35,000.

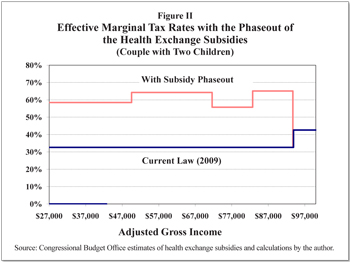

Marginal Tax Rates on Families. Figure II shows the impact of the subsidy phaseout on a family of four who buy their own insurance through a health insurance exchange. As before, the bottom line is based on current law, and includes federal income and payroll (OASDI) taxes, and state income tax. In addition to the health insurance subsidy, the Earned Income Tax Credit (EITC) phases out as income rises, further increasing the marginal tax rate. For a couple with two children, the EITC phases out between earned incomes of $19,540 and $43,415 in 2009:

Marginal Tax Rates on Families. Figure II shows the impact of the subsidy phaseout on a family of four who buy their own insurance through a health insurance exchange. As before, the bottom line is based on current law, and includes federal income and payroll (OASDI) taxes, and state income tax. In addition to the health insurance subsidy, the Earned Income Tax Credit (EITC) phases out as income rises, further increasing the marginal tax rate. For a couple with two children, the EITC phases out between earned incomes of $19,540 and $43,415 in 2009:

- Initially, the family is in the 10 percent federal income tax bracket, but its combined marginal tax rate is almost 49 percent due to the phaseout of the EITC, which the family loses at a 21.06 percent marginal rate.

- The marginal rate jumps further when the family enters the federal income tax's 15 percent bracket.

- Once the EITC has phased out, the family's combined marginal tax rate under current law drops to just under 33 percent.

- It rises again, to 42.6 percent, when the family reaches the 25 percent federal income tax bracket at an AGI (in this example) of about $94,000.

The upper line adds the implicit marginal tax rate due to the phaseout of the health exchange subsidy. This produces marginal tax rates over a broad range of lower middle-incomes that are always above 55 percent, usually above 60 percent, and sometimes above 70 percent.

"Cliffs" in Marginal Tax Rates. The figures are drawn as though the subsidy smoothly phases out between the pairs of incomes for which CBO provides subsidy estimates. In practice, the phaseout would have some "cliffs," mainly associated with the subsidy applying to out-of-pocket expenses. In the immediate vicinity of the cliffs, a few dollars of added income would cut the subsidy by hundreds or thousands of dollars, raising marginal tax rates.

Also, the figures does not show that while most people earning 150 percent of the poverty level or less could obtain free Medicaid coverage under the bill, they would suddenly lose the free Medicaid coverage if they earned even a few dollars more.

Behavioral Effects. The subsidy phaseout would penalize lower- and middle-income families for working and saving. Because of the steep implicit tax, many individuals with incomes within the phaseout range would reduce their productive efforts. The phaseout would also encourage many lower- and middle-income people to work off the books because a dollar of income under the table would often be worth two or two-and-a-half dollars over the table.

Michael Schuyler is senior economist at the Institute for Research on the Economics of Taxation (IRET).