In the fall of 2008, the Dow Jones Industrial Average fell to its lowest level in five years, prompting even steadfast savers to panic. The average 401(k) account fell 23 percent in 2008, according to the Employee Benefits Research Institute (EBRI).

The 2009 NCPA Brief Analysis, “Is the Mattress a Good Place for Money?,” compared returns from different savings strategies from 2008 to 2009. The result? Even during a tumultuous year for the market, a stock index fund outperformed a bond index fund, a money market account or simply hiding the money in the mattress, so to speak. Revisiting the downturn, would an investor have been better off if he had steadily contributed to an equity fund from December 2008 through December 2010? A comparison of returns from some of the alternatives indicates he would have been better off staying in the market.

Can Boomers Recover? The Employee Benefit Research Institute reports that due to the 2008 financial and housing market crises, younger baby boomers (ages 46 to 55) would need to save an additional 4.3 percent of their labor income in order to have a 90 percent probability of adequate retirement income. EBRI notes the sharp decline in the value of retirement savings plans and real estate prices as primary reasons. Many savers are depending on profits from selling their home and purchasing a cheaper one as a source of retirement income. But retirement readiness also depends on what individuals did in response to the market downturn. Some individuals moved money in their 401(k) and Individual Retirement Accounts (IRA) from equities to bonds, while others suspended contributions to retirement plans altogether.

Can Boomers Recover? The Employee Benefit Research Institute reports that due to the 2008 financial and housing market crises, younger baby boomers (ages 46 to 55) would need to save an additional 4.3 percent of their labor income in order to have a 90 percent probability of adequate retirement income. EBRI notes the sharp decline in the value of retirement savings plans and real estate prices as primary reasons. Many savers are depending on profits from selling their home and purchasing a cheaper one as a source of retirement income. But retirement readiness also depends on what individuals did in response to the market downturn. Some individuals moved money in their 401(k) and Individual Retirement Accounts (IRA) from equities to bonds, while others suspended contributions to retirement plans altogether.

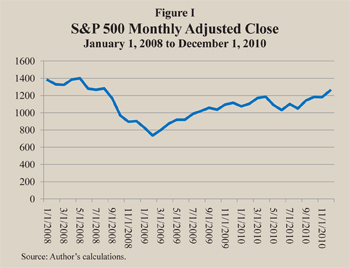

2009 versus 2010. The Dow Jones Industrial Average (which tracks 30 blue chip stocks) gained 77 percent from March 2009 to January 2011, more than the average 50 percent gain during a similar period in previous bull markets, according to columnist Will Deener. Two months gave hope to those who had shied away from or dumped equities:

- In March 2009, the Standard & Poor’s (S&P) 500 (an index of leading stocks) posted its biggest 10-day gain since 1938. [See Figure I.]

- In November 2010 the Dow Jones Industrial Average topped 10,000 for the first time since September 2008.

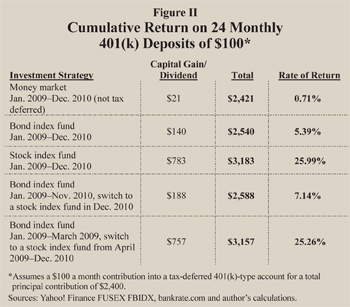

Figure II shows what workers could have earned on monthly 401(k) contributions from December 1, 2008, to December 31, 2010.

- A $100 monthly (taxable) contribution to a traditional savings account invested in money market funds would have yielded $21 — a 0.71 percent after-tax return.

- A $100 monthly tax-deferred contribution to a bond index fund would have yielded $140 — a 5.39 percent rate of return.

- A $100 monthly tax-deferred contribution to an S&P index fund would have yielded $783 — a return of nearly 26 percent.

Timing the Market. Is buying when prices are on the rise a better strategy than sticking with the market through thick and thin? Indeed, there are many radio shows and books dedicated to market timing. But following this strategy can be time-consuming, and most experts agree that those who invest this way rarely purchase stocks at the optimal time. Thus, a saver who recommences contributions to equity funds he exited in fall 2008 may end up purchasing shares at much higher prices than if he had stayed in the fund during the downturn. Consider two scenarios:

Returning to an Equity Fund in December 2010. Suppose that an individual had transferred her accumulated contributions from December 2008 to November 2010 from a bond index fund to a stock index fund, then made an additional $100 contribution in December 2010. The fourth row in Figure II shows that as of December 31, 2010, the total $2,400 principal contribution plus interest would be about $2,588. The effective annual rate of return would be 7.14 percent.

Returning to an Equity Fund in December 2010. Suppose that an individual had transferred her accumulated contributions from December 2008 to November 2010 from a bond index fund to a stock index fund, then made an additional $100 contribution in December 2010. The fourth row in Figure II shows that as of December 31, 2010, the total $2,400 principal contribution plus interest would be about $2,588. The effective annual rate of return would be 7.14 percent.

Returning to an Equity Fund in March 2009. Suppose that a saver who had moved money into a bond index fund in December 2008 shifted her accumulated bond fund money into a stock index fund in March 2009 and made regular contributions to the fund starting in April 2009. The fifth row in Figure II shows that as of December 31, 2010, the total $2,400 principal contribution plus dividends would be about $3,157 — a 25.3 percent return. Thus, those who contributed sooner during the market upswing experienced greater percentage gains than those who remained in money market or bond funds.

Conclusion. Everybody has their own comfort level when it comes to investment risk. But selling and shifting money out of an asset when it is priced low is a sure way to lock in a loss.

Pamela Villarreal is a senior policy analyst with the National Center for Policy Analysis.