Source: Industry Today

Based on President Obama’s 2013 budget, one would think he is an avid supporter of all things “research and development.” He proposes $140 billion on the R&D of “green” energy and other things such as wireless communications and cyber security. It is apparent that the budget aims to reflect R&D commitment, but the funds committed are limited to targeted projects. The government’s track record of subsidizing specific industries while ignoring others is questionable – consider such evidence: recent bankruptcies of several “green” energy companies.

Noticeably absent from Obama’s budget is a much needed extension of the R&D tax credit. It was available through last year to any company, large or small, in any industry that is producing a new innovation or improving an existing product. Despite all of the talk about the United States losing its competitive edge and the need to crawl out of the abyss, the R&D tax credit is non-existent this year unless Congress decides to extend it and make it retroactive for tax year 2012.

The tax credit was first enacted in 1981 to improve international competitiveness of American businesses by encouraging innovation and new technology. Concerned about the budgetary impact of lost tax revenue, Congress never made the credit permanent – though it has renewed it 14 times. This creates year-to-year uncertainty for firms that wish to plan for the long term.

The R&D tax credit reduces a firm’s federal tax liability based on the amount spent on wages, patent attorney fees and so forth to develop a new product or improve existing products. Over the years, the credit has had several names and it has been calculated in various ways. In recent years, firms have basically had two tax credit options: the regular research credit or the alternative simplified credit. The regular research credit is allowed for spending in excess of a specified base amount – the ratio of research and development to sales expenses in previous years. The base period is 1984 to 1988 for firms that existed at that time, and they receive a 20-percent credit on R&D. For example, if a corporation spends $500,000 on research and has sales expenses of $500,000 in a given year, its base ratio is 1:1. If its R&D spending remained the same the following four years, but its sales expenses increased to $1 million, it would not be eligible for the tax credit until it re-established a 1:1 ratio by increasing R&D spending beyond $1 million.

Since 2007, the alternative simplified credit has been available. It is a 14-percent credit for expenses in excess of 50 percent of R&D expenditures averaged over the firm’s three preceding tax years. This allows a firm to continue receiving the credit even if research costs are level or decrease. A small start-up firm with no previous years’ expenses can claim six percent of its current year research expenses against its tax liability. A start-up firm with no tax liability can carry the credit forward up to 20 years.

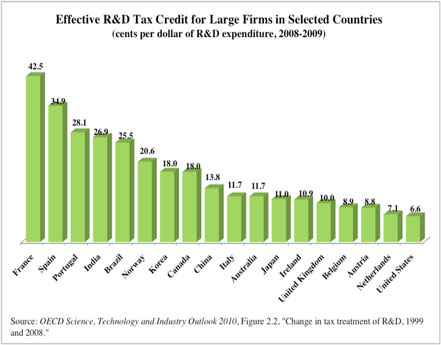

At one time, the US R&D credit enacted was the most generous of any nation. However, 14 other developed countries, and the three largest developing countries—China, India and Brazil—now have more generous R&D tax credits than the United States [see the figure]:

- France tops the list, with a 42.5 cent effective tax credit for every dollar of R&D spending.

- India ranks fourth, with a credit of 26.9 cents per dollar of R&D.

- Brazil ranks fifth, with a credit of 25.5 cents per dollar.

- China ranks eighth, at 13.8 cents per dollar.

Meanwhile, the United States has an abysmal 17-percent ranking, with an effective tax credit of 6 cents – even lower than it was three years ago.

Moreover, China and India provide generous incentives to lure international companies to conduct research and development in their countries. A Deloitte survey found that China offers foreign firms a 150-percent tax deduction for R&D, as long as R&D expenditures grow 10 percent from the previous year. India offers a 100- to 200-percent tax deduction for R&D, depending on the type of industry.

In 2011, the public and private sectors in the United States spent a combined $436 billion on research and development. It is commonly believed that the federal government is a large funder of R&D projects and, therefore, private industries should not be given additional perks in the form of tax credits. Yet direct federal money for research accounted for less than nine percent of private industry research spending. Including government loans and tax advantages, private industry still funded almost two-thirds of its research.

Two policy changes would make the R&D credit competitive with other countries:

- First, increase the credit. Many have suggested increasing the alternative simplified credit from 14 percent to 20 percent. According to Ernst and Young, increasing the simplified credit will increase R&D spending by an additional $5 billion in the short-run and by $8 billion to $18 billion in the long-run. Increasing the alternative simplified credit, combined with the regular research credit under current law, would increase R&D spending by $23 billion to $53 billion.

- Second, the R&D tax credit should not be contingent on a year-to-year renewal. Even though it has been repeatedly extended, the last-minute decision-making creates uncertainly for firms wishing to plan over several years.

Note to Congress and the administration: Please renew the R&D tax credit—as soon as possible!—so that it is available to all firms. Increase the credit, so that other countries don’t out-compete the United States for research dollars. Extend the credit at least 10 years so that firms aren’t subjected to annual last-minute extensions.

Author Pamela Villarreal is the NCPA’s expert on economic growth, tax issues, retirement and Social Security. NCPA is a nonprofit, nonpartisan public policy research organization. Established in 1983, it develops and promotes private, free-market alternatives to government regulation and control. For more information, visit www.ncpathinktank.org. Access Villarreal’s blog at http://retirementblog.ncpathinktank.org